The Ministry of Corporate Affairs (MCA) notified the constitution of the National Company Law Tribunal (‘NCLT’) and National Company Law Appellate Tribunal (‘NCLAT’) in the exercise of powers conferred under sections 408 and 410 of the Companies Act, 2013.

The NCLT and the NCLAT act as quasi-judicial bodies which adjudicate/decide all disputes relating to companies in India. The establishment of NCLT and NCLAT as specialized Tribunals with a professional approach towards corporate dispute settlement has the following beneficial effects:

- Specialized Tribunals, only for corporates, and consisting of both judicial as well as technical members for deciding the matters.

- Decrease the pendency of winding-up cases and reduce the period of the winding-up process,

- avoid multiplicity of litigation before High Courts (HC) and quasi-judicial Authorities

- the appellate procedure has streamlined with an appeal against the order of the NCLT lying before NCLAT and with a further appeal against the order of NCLAT lying with the Supreme Court only on points of law,thereby decreasing the delay in appeals; and

- the burden on High Courts has been reduced.

Regulatory Framework before NCLT/NCLAT

- The Companies Act, 2013.

- National Company Law Tribunal Rules, 2016.

- National Company Law Appellate Tribunal Rules, 2016(NCLAT).

- Companies (Compromise, Arrangements, and Amalgamations) Rules, 2016

- Insolvency and Bankruptcy Code, 2016 (IBC) and Rules and Regulations framed thereunder from time to time.

National Company Law Tribunal (NCLT)

The CGunder section 408 of the companies Act, 2013, constituted National Company Law Tribunal (NCLT), consisting of a President and such number of Judicial and Technical members, as the CG may deem necessary, to be appointed by it by notification, to exercise and discharge such powers and functions as are, or maybe, conferred on it by or under this Act or any other law.

Constitution of NCLAT

The Central Government (CG) constituted National Company Law Appellate Tribunal consisting of a Chairperson and such number of Judicial and Technical Members,not exceeding 11, as the Central Government (CG) may deem fit, to be appointed by it by notification, for hearing appeals against—

- the order of the Tribunal or the National Financial Reporting Authority (NFRA) under this Act; and

- Any decision, direction, or order referred to in section 53N of the Competition Act, 2002 by the provisions of that Act.

Procedure before Tribunal and Appellate Tribunal (Section 424)

(1) The NCLT and NCLATwhile disposing of any proceeding or an appeal, shall not be bound by the procedure mentionedin the Code of Civil Procedure, 1908 (CPC), the Tribunal (NCLT) and the Appellate Tribunal (NCLAT) shall have the power to regulate their procedure.

(2) The Tribunal and the Appellate Tribunal (NCLT/NCLAT) shall have, to discharge their functions under this Act or the Insolvency and Bankruptcy Code, 2016 (IBC) have the same powers as are vested in a civil court while trying a suit in respect of the following matters, namely:-

- Summoning and enforcing the attendance of any person and

- Examininga person on oath.

- Requiring the discovery and production of documents.

- Receiving evidence on affidavits.

- Requisitioning any public document or record from any office.

- Issuing commissions for the examination of witnesses or any documents.

- Dismissing a representation for default or deciding it ex-parte.

- Setting aside any order of dismissal of any representation for default or any order passed by it ex-parte; and

- Any other matter which may be prescribed.

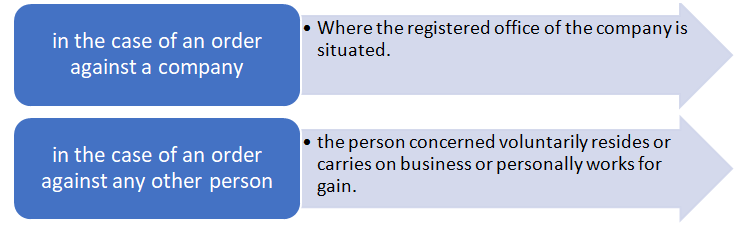

(3) Any order made by the NCLT or NCLAT may be enforced by that Tribunal in the same manner as if it were a decree made by a court, and it shall be lawful for the NCLT or NCLAT to send for the execution of its orders to the court within the local limits of whose jurisdiction: –

(4) All proceedings before the Tribunal or the Appellate Tribunal (NCLT/NCLAT) shall be deemed to be judicial proceedings.

This content is meant for information only and should not be considered as an advice or legal opinion, or otherwise. AKGVG & Associates does not intend to advertise its services through this.

Posted by:

CS Neetu Saini

AKGVG & Associates