What is a Tax Audit? Tax audit definition can be defined as a methodical audit of the accounts, records and financial statements of a company to distribute the effectual tax reporting and law abidance. It is carried out by a chartered accountant or a qualified professional who is assigned as per the applicable tax regulations….

Tag: Tax audit consultant in India

Tax Audit: The Key to Smarter Tax Planning and Stronger Compliance

An audit is more than simply an exercise in the law – it is a service and a useful way of ensuring transparency and accountability in what can sometimes be opaque finances. Companies that are in constant state of being audited do more than just comply with the law – they maintain better and stricter…

The Essential Guide to IT Audits for Modern Businesses

Organizations rely a lot on technology in their day-to-day activities, data storage, and communication in the current digital-driven era. Although this dependence is efficient, it leads businesses to dangers like cyberattacks, data loss, and system crashes. IT Audit can be critical in this respect as information systems are carefully inspected in an organization. It guarantees…

What Is a Tax Audit and Why It Matters for Businesses

A tax audit refers to specific intrusion into the financial records of a business and is conducted to determine fairness in recording the amount of income and claims of expenses as well as overall adherence to the provisions of the Income Tax Act. It makes sure that books of accounts give true and fair view…

Tax Audit in India: Key Goals & Importance

Compliance is an asset of business in India as it helps in its smooth running and eventual expansion. A tax audit is a key requirement for ensuring compliance with the Income Tax Act. Tax audits conducted to give integrity to financial records and tax filing processes not only enhances transparency but also helps a business…

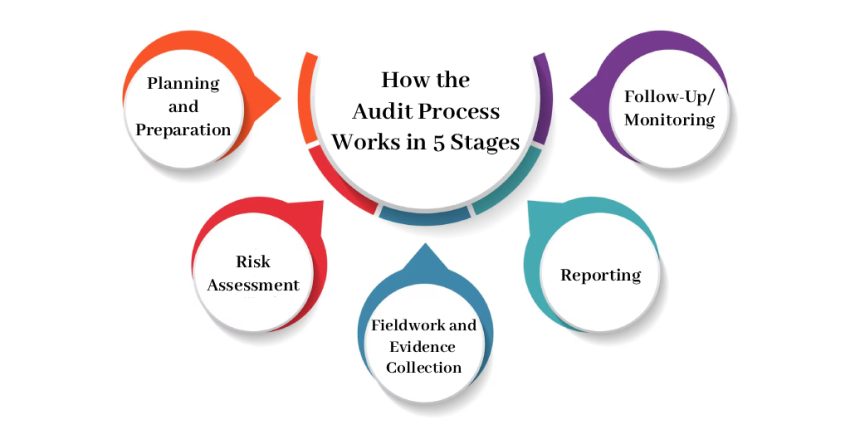

How the Audit Process Works in 5 Stages

Audits play a crucial role in ensuring accuracy, transparency, and compliance in business operations. Whether it is an internal audit or a statutory audit, following a structured process helps businesses maintain accountability and build trust with stakeholders. The 5 stages of audit process form the foundation of this structured approach, guiding auditors and businesses alike…

Revealing the Core of Tax Audit Firms

In the realm of financial responsibilities, navigating the intricate web of duty regulations can be a daunting task for individuals and businesses alike. This is where tax audit firms emerge as invaluable partners, providing a beacon of expertise and guidance in the labyrinth of taxation. As the capital city of India, Delhi stands as a…