Auditing plays an important role in the governance framework of an organization as it assists in maintaining accuracy, transparency and accountability. Although both internal and external audits are aimed at enhancing business operations and financial reporting, they have various purposes and engage themselves in different ways. The awareness of internal and external audits varies can enable companies to be better prepared, spend their resources more efficiently, and comply with regulations. The difference between these two crucial functions of the audit is clearly explained here.

Purpose and Objective

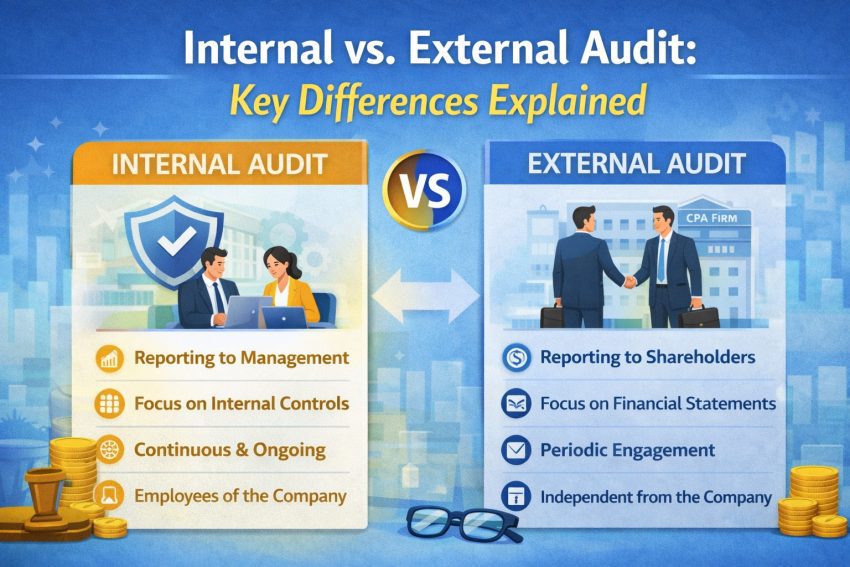

The primary purpose of an internal audit is to evaluate and improve the effectiveness of internal controls, risk management, and operational processes. Internal auditors work within the organization to identify gaps, suggest improvements, and help management enhance efficiency.

Conversely, external audit is a method used to give independent opinion on the equity and fullness of financial statements of a company. Third-party auditors carry it out with the view of ensuring that the financial information is presented in accordance with the relevant accounting standards and regulatory measures.

Independence and Reporting Structure

Internal auditors are employees of the organization or may be hired as part of an internal audit function. They report to senior management and, ideally, to the audit committee of the board of directors. Their work supports decision-making and internal governance.

External auditors on the other hand are independent professionals who are hired by the shareholders or the board. They should be very independent to provide impartial and unbiased financial audit reports. Their results are provided to the shareholders, regulators, and the stakeholders.

Scope of Work

Internal audits have a broad and flexible scope. They may cover financial controls, operational efficiency, and compliance with policies, cybersecurity, fraud detection, and even environmental or quality audits. Their scope is determined by management’s priorities and evolving business risks.

External audits are more prescriptive in nature, and the scope usually concerned itself with financial statements and other disclosures. Their efforts guarantee sound financial reporting of the company, and it is not affected by any material misstatements.

Frequency of Audits

Internal audits are conducted regularly, monthly, quarterly, or annually based on the audit plan. Organizations may also conduct special audits in response to emerging risks or incidents.

External audits are normally carried out at least once in a year. In some organizations, further limited reviews can be conducted; statutory audits are based on an annual cycle.

Approach and Methodology

Internal auditors use a risk-based approach, diving deep into systems and processes to identify vulnerabilities. They may conduct walkthroughs, test controls, evaluate compliance, and recommend corrective actions.

External auditors are concerned with testing the financial data, account balance testing, testing the documentation and evaluating the internal control environment in terms of financial reporting.

Outcome and Deliverables

Internal audit reports provide insights and recommendations to improve operations. They highlight risks, inefficiencies, and improvement opportunities. These reports remain confidential within the organization.

External audits lead to an audit opinion such as unqualified, qualified, adverse, or disclaimer showing whether the financial statements provide a true and fair opinion. Such reports are usually released onto the market and are critical to investor confidence.

Conclusion

External and internal audits are important in enhancing credibility and performance of business. Internal audits assist organizations to improve processes and risk management, whereas external audits make sure that financial operations are transparent and that they comply with regulations. Knowing their distinctions helps the businesses to utilize both functions to their advantage and contribute to growth of their organizations in the long run.

This content is meant for information only and should not be considered as an advice or legal opinion, or otherwise. AKGVG & Associates does not intend to advertise its services through this.

Also Read: The basics of internal and external audit