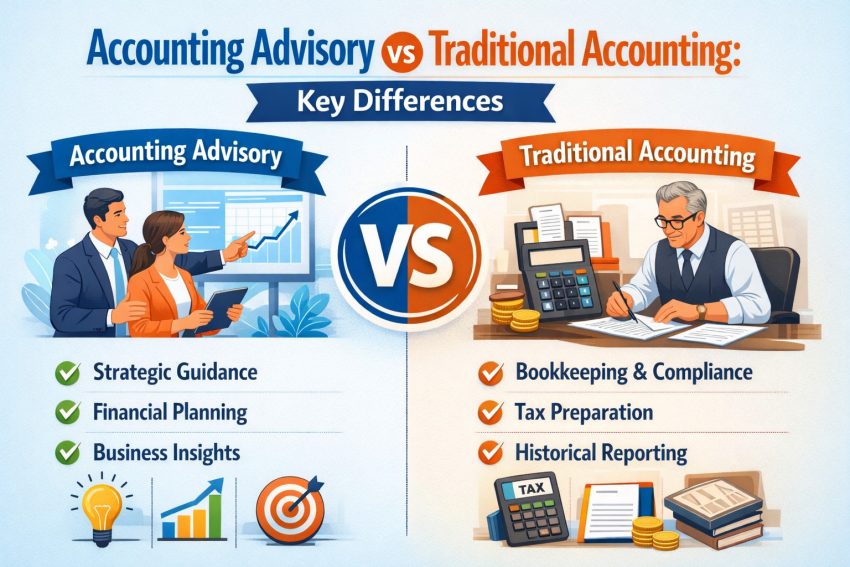

In today’s fast-evolving business environment, the role of accountants has expanded far beyond data entry, bookkeeping, and compliance. As companies face increasing financial complexity, the need for strategic financial guidance has grown, giving rise to accounting advisory services. While traditional accounting remains essential for day-to-day financial operations, advisory services focus on future-oriented planning, decision-making, and performance improvement. Understanding the difference between these two functions helps businesses choose the right support based on their needs.

Nature of Services Provided

Traditional accounting is basically more of compliance and documenting financial records. This comprises bookkeeping, preparing financial statements, keeping of ledgers, calculation of tax and compliance with statutory requirements. It is aimed at providing a realistic image of the past and present financial operations of a company.

Accounting advisory services on the other hand move a step further. They are visionary and progressive. Advisory professionals assist companies to analyze the financial data, enhance internal operations, optimize taxes, and take effective decisions. They aim at delivering information that helps them grow, be efficient, and have long-term plans.

Focus: Historical vs. Future-Oriented

Conventional accounting is strongly based on the past. It records past events that have taken place like sales, expenses, profits and losses. This retroactive method is necessary to comply and report.

The accounting advisory services always look into the future. They apply financial forecasts, trend analysis, scenario planning, and performance metrics in managing decisions. This is a proactive strategy that assists companies in estimating dangers, determination of possibilities, and strategy.

Level of Involvement in Business Decisions

Traditional accountants typically play a limited role in decision-making. Their main responsibility is to provide accurate, reliable financial records and ensure regulatory compliance. Once the reports are prepared, the responsibility shifts to management.

However, the professionals of the advisory service participate in the decision-making process to a large extent. They work with the leadership teams to analyze financial data, create financial models, analyze investments, and devise business expansion strategies. They are collaborators who will play an active role in business direction.

Problem-Solving Approach

Conventional accounting is concerned with routine and standardized processes. Audits, reconciliations or adjustments are used to correct any deviations or contrasts.

Advisory services revolve around the solving of broader financial issues. This can involve cash flow improvement, debt restructuring, profitability, new accounting systems or even mergers and acquisitions. Advisors are holistic and they will offer solutions specific to the business.

Tools and Techniques Used

Conventional accounting involves the use of some established tools like ledger books, accounting software, journal entries, and compliance structures. These applications facilitate proper record keeping and creation of financial reports.

The advisory services are based on sophisticated analytical software, dashboards, financial modeling software, and performance monitoring software. Advisors combine technology and analytics to provide actionable insights and enable digital transformation.

Value Delivered to Businesses

The benefits of traditional accounting are that it provides accuracy, reliability and compliance which is vital to any organization.

Added value in accounting advisory services is in the enhancement of performance in financial terms, assisting in strategic planning, and enabling businesses to remain competitive in a changing environment.

Final Thoughts

Traditional accounting as well as accounting advisory services are significant in the management of a business. Traditional accounting will provide a good financial base, and advisory will give the businesses the confidence to continue. Knowing the distinction, companies can use both functions to stay stable, promote growth and succeed over time.

This content is meant for information only and should not be considered as an advice or legal opinion, or otherwise. AKGVG & Associates does not intend to advertise its services through this.