With the current fast developing business environment, this professional accounting practice is no longer adequate to accommodate the increasing need in precision, performance and accessibility. Financial companies are increasingly opting in to cloud-based accounting services that offer quicker, safer and more efficient financial accounting services. Real-time accessibility, place-independence, cost-reduction through lack of heavy infrastructure and…

What Is a Tax Audit and Why It Matters for Businesses

A tax audit refers to specific intrusion into the financial records of a business and is conducted to determine fairness in recording the amount of income and claims of expenses as well as overall adherence to the provisions of the Income Tax Act. It makes sure that books of accounts give true and fair view…

How Symantec Endpoint Protection Differs from Other Security Tools

In the era of the digital world, companies and people depend on technology a lot to run affairs efficiently. This is both a boon and a bane as a surge in speed and efficiency is made possible at the risk of cyber threats like malware, ransomware, and phishing attacks. Companies overcome these risks by employing…

Risk Advisory Simplified: Finance & Operations

All business must contend with uncertainty. Whether it is financial or day-to-day operations related to risks, they are always present in operating any organization. The effective management of these risks gives a company the impetus to be stable and grow confidently. Here is where risk advisory comes into the picture. The question most business leaders…

ICFR Explained: Boosting Financial Transparency

Transparency of finances is among the most critical keys of trustworthiness of any organization. Firms are expected to submit their financial statements in a form that is fair, true and not deceptive. To realize this, businesses implement procedures and controls that ensure their financial records are accurate. This is where ICFR will play a part….

GSTR-2A vs GSTR-2B: Avoid Errors in GST Compliance

GST system in India has introduced considerable changes in the way business manages compliance and input tax credit (ITC). Out of the various forms/payments that are introduced under GST, GSTR-2A and GSTR-2B tend to confuse the taxpayers. Both are associated with ITC claims but are used to different ends. Learning the difference between GSTR 2A…

Assurance in Business: Importance in the Digital Age

Assurance in business is the procedure of scrutinising and validating the accuracy of information, systems and processes in an orderly way to ensure they are accurate, dependable and that they adhere to statutory requirements. It is one of the most important practices that inspire confidence within the stakeholders, investors, and regulators by confirming their reliability…

Tax Audit in India: Key Goals & Importance

Compliance is an asset of business in India as it helps in its smooth running and eventual expansion. A tax audit is a key requirement for ensuring compliance with the Income Tax Act. Tax audits conducted to give integrity to financial records and tax filing processes not only enhances transparency but also helps a business…

What are 15CA and 15CB? A Beginner’s Guide to Taxpayers

When it comes to international money transfers from India, tax compliance becomes an important factor. The Income Tax Department requires specific declarations to ensure that taxes are properly deducted and reported on foreign remittances. This is where 15CA and 15CB forms come into the picture. For many taxpayers, these forms may appear complicated, but with…

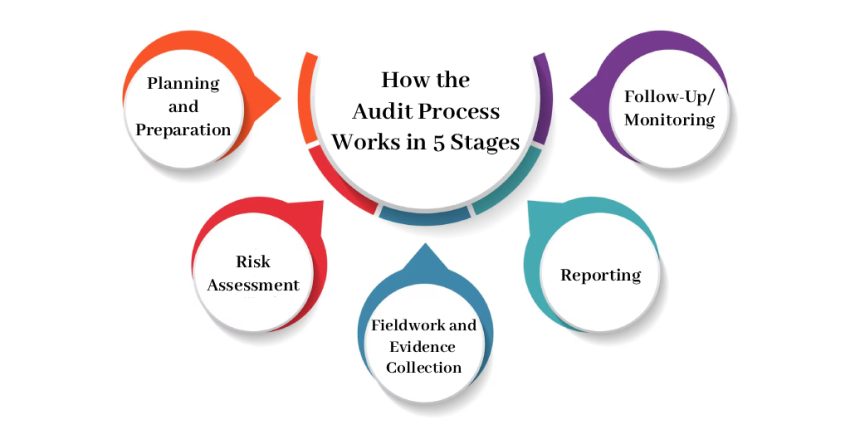

How the Audit Process Works in 5 Stages

Audits play a crucial role in ensuring accuracy, transparency, and compliance in business operations. Whether it is an internal audit or a statutory audit, following a structured process helps businesses maintain accountability and build trust with stakeholders. The 5 stages of audit process form the foundation of this structured approach, guiding auditors and businesses alike…