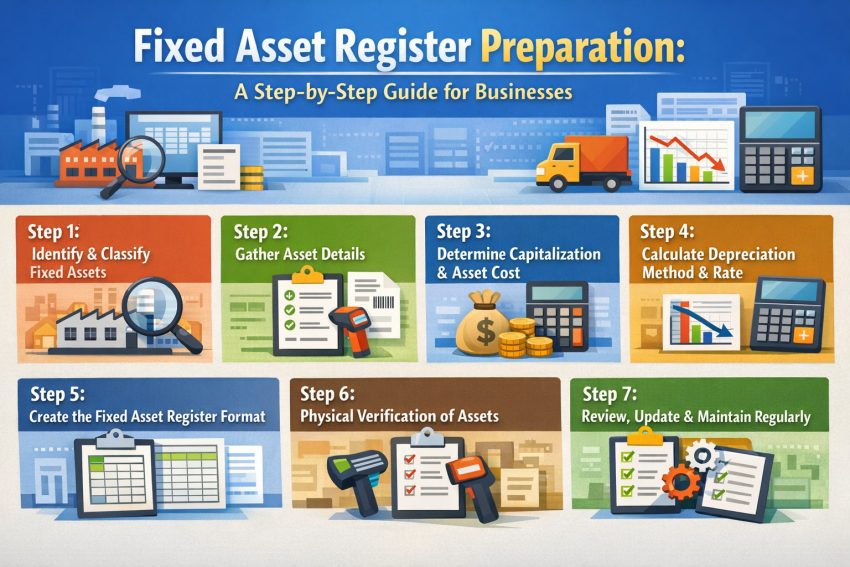

Managing business assets efficiently is essential for accurate financial reporting, compliance, and decision-making. A well-maintained Fixed Asset Register (FAR) helps organizations track asset value, location, usage, and depreciation over time. This step-by-step guide explains how businesses can carry out fixed asset register (FAR) preparation in a structured and practical manner.

Step 1: Identify and Classify Fixed Assets

The initial stage in fixed asset register (FAR) preparation is to establish the existence of every fixed asset that the business possesses. Land, buildings, machinery, furniture, vehicles, computers, and equipment that are employed in long-term operations are normally considered as fixed assets. Upon identification, the assets are to be categorized in the relevant category to make it easy to calculate depreciation and tracking.

Step 2: Gather Asset Details

Precise information gathering is essential. Collect the required parameters (asset description, date of purchase, invoice value, supplier, asset location, and other unique identification number) of each asset. Warranty information and expected useful life should also be recorded in the fixed asset register (FAR) preparation because it assists business in planning finances and operations.

Step 3: Determine Capitalization and Asset Cost

Businesses must determine which expenses should be capitalized and included in the asset’s cost. This can be purchasing price, installation expenses, transportation, taxes and other costs which can be directly attributed. Clear capitalization policy provides consistency in the preparation of the fixed asset register (FAR) and prevents misstatement of the value of assets in financial records.

Step 4: Calculate Depreciation Method and Rate

Depreciation reflects the gradual reduction in asset value over time. Companies should decide the appropriate depreciation method—such as straight-line or written-down value—based on accounting standards and internal policies. Selecting the correct depreciation rate is an important part of fixed asset register (FAR) preparation, as it directly impacts profit calculation and tax compliance.

Step 5: Create the Fixed Asset Register Format

The FAR could be stored in spreadsheets or special asset management software. A typical register must contain code of assets, assets name, category, and date of purchase, cost of assets, depreciation rate, accumulated depreciation, net book value, and information on disposal. An efficient format enhances accuracy and easiness during the fixed asset register (FAR) preparation.

Step 6: Physical Verification of Assets

Physical verification is done to ascertain whether the assets that were listed in the register exist and in a usable state. The move assists in determining the missing, outdated, or spoilt assets. Internal checks become stronger because of regular verification and increase the trustworthiness of financial statements associated with the FAR.

Step 7: Review, Update, and Maintain Regularly

Fixed asset registers are not documents of one type. During the year, assets can be bought, transferred, impaired or disposed. Businesses need to revise the FAR on a regular basis to incorporate these changes. One of the major results of the proper fixed asset register (FAR) preparation is continuous monitoring that will guarantee the maintenance of compliance and proper reporting.

Conclusion

An organized method in the preparation of the fixed asset registers assists businesses in being financially disciplined, assisting with the audits and compliance with statutory requirements. By implementing these steps, organizations will be able to create a stable FAR that will help to increase transparency and control assets. The fixed asset register (FAR) preparation is a worthwhile financial management habit and no longer a compliance burden as it needs to be properly planned and kept up to date.

This content is meant for information only and should not be considered as an advice or legal opinion, or otherwise. AKGVG & Associates does not intend to advertise its services through this.

Also Read: Fixed Asset Register Checking: Decoding it’s significance