GST system in India has introduced considerable changes in the way business manages compliance and input tax credit (ITC). Out of the various forms/payments that are introduced under GST, GSTR-2A and GSTR-2B tend to confuse the taxpayers. Both are associated with ITC claims but are used to different ends. Learning the difference between GSTR 2A…

Assurance in Business: Importance in the Digital Age

Assurance in business is the procedure of scrutinising and validating the accuracy of information, systems and processes in an orderly way to ensure they are accurate, dependable and that they adhere to statutory requirements. It is one of the most important practices that inspire confidence within the stakeholders, investors, and regulators by confirming their reliability…

Tax Audit in India: Key Goals & Importance

Compliance is an asset of business in India as it helps in its smooth running and eventual expansion. A tax audit is a key requirement for ensuring compliance with the Income Tax Act. Tax audits conducted to give integrity to financial records and tax filing processes not only enhances transparency but also helps a business…

What are 15CA and 15CB? A Beginner’s Guide to Taxpayers

When it comes to international money transfers from India, tax compliance becomes an important factor. The Income Tax Department requires specific declarations to ensure that taxes are properly deducted and reported on foreign remittances. This is where 15CA and 15CB forms come into the picture. For many taxpayers, these forms may appear complicated, but with…

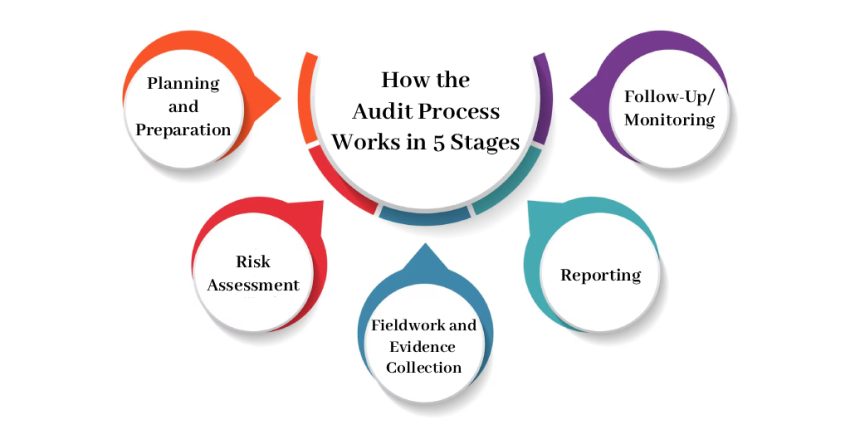

How the Audit Process Works in 5 Stages

Audits play a crucial role in ensuring accuracy, transparency, and compliance in business operations. Whether it is an internal audit or a statutory audit, following a structured process helps businesses maintain accountability and build trust with stakeholders. The 5 stages of audit process form the foundation of this structured approach, guiding auditors and businesses alike…

Forensic Audit: A Key Tool for Detecting Fraud & Supporting Legal Cases

In today’s business landscape, fraud and financial disputes can disrupt operations and cause major losses. To address such cases, companies and law enforcement rely on a forensic audit—a specialized process that examines financial records in detail to detect anomalies and gather evidence admissible in court. What Is Forensic Audit? To define what forensic audit is,…

Form 15CA & 15CB: Simplifying International Payments

When businesses or individuals transfer money abroad, they are doing more than sending money out of India. Tax authorities are on guard to see that the correct amount of taxes is collected and that no money is transferred without obeying the law in this context, two forms are particularly important: Form 15CA and Form 15CB. To…

The Four Pillars of Accounting That Drive Business Success

Accounting is the backbone of every business, ensuring transparency, efficiency, and compliance with laws such as the Companies Act, Income Tax Act, and GST in India. Beyond statutory needs, sound accounting practices support informed decision-making, cost control, and long-term sustainability. Choosing the right type of accounting—financial, cost, management, or tax—helps businesses optimize resources, drive growth,…

Internal Financial Controls (IFC): Key Challenges in Applicability and Compliance

The Internal Financial Control (IFC) has grown to be a significant component of corporate governance and compliance in India. It also makes companies manage to have checks and balances in their financial operations. The aim is to develop more transparency and accountability; however, organizations are usually faced by some hindrances in ensuring the applicability of…

Physical vs. Perpetual Inventory Audits: Finding the Right Fit for Your Business

Effective handling of inventory is one of the essential components of managing any goods related business. Frequent checking can assist in maintaining stock records (being correct) and not letting any discrepancies pass unnoticed. It is here where inventory audit procedures become significant. There are many ways to approach auditing, but physical and perpetual audits are…