The ferocious second wave of COVID-19 threatens people’s lives as coronavirus has blown a hole in the breathing capacity of an individual. An unprecedented surge in covid-19 cases has made Medical oxygen- a necessity for a patient to survive. However, most of the hospitals started running out of oxygen supply as demand for medical oxygen amplified.

As India agonizes for breath, an oxygen concentrator is found to be the most sought-after device for oxygen therapy, especially among Covid-19 patients in home isolation and for hospitals running out of oxygen. The oxygen concentrator is a medical device that concentrates oxygen from ambient air. It takes in the air, filters it through a sieve, releases the unnecessary components back into the air, and accumulates the oxygen.

Oxygen concentrators can supply a continuous stream of oxygen at flow rates of up to 10 litres of oxygen per minute while cylinders can only store a restricted volume. As a result, Oxygen concentrators have become a reliable substitute for meeting the escalating demand for oxygen.

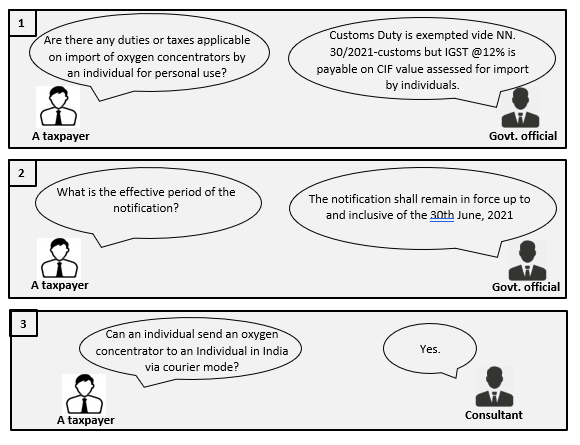

Now, many of us must have numerous questions running in the mind regarding the taxability of oxygen concentrators and their import procedures. Let us look at the importation of Oxygen concentrators and its GST implications:

To ease the acute shortage in oxygen-generating medical devices in the country amidst the second wave of the coronavirus pandemic, the government waived off customs duty on the import of certain medical supplies. It includes a waiver of customs duty on imported Remdesivir injections and the drug’s active pharmaceutical ingredients, oxygen concentrator, and many more to boost supplies of such products in the country.

India has been struggling with COVID-19 for more than a year now. The nation battles its worst health crisis with a higher number of fresh cases being reported from across India every day. Now, it’s time to stay united to make India fight corona.

This content is meant for information only and should not be considered as an advice or legal opinion, or otherwise. AKGVG & Associates does not intend to advertise its services through this.

Posted by:

CA Tarun Kapoor

AKGVG & Associates