When it comes to financial reporting and maintaining business transparency, both audit and assurance play a vital role These terms are often confused with one another, but they are not identical. Understanding the difference is crucial for businesses, stakeholders, and finance students alike since each serves a unique purpose in ensuring accuracy and trust in information.

What is Assurance?

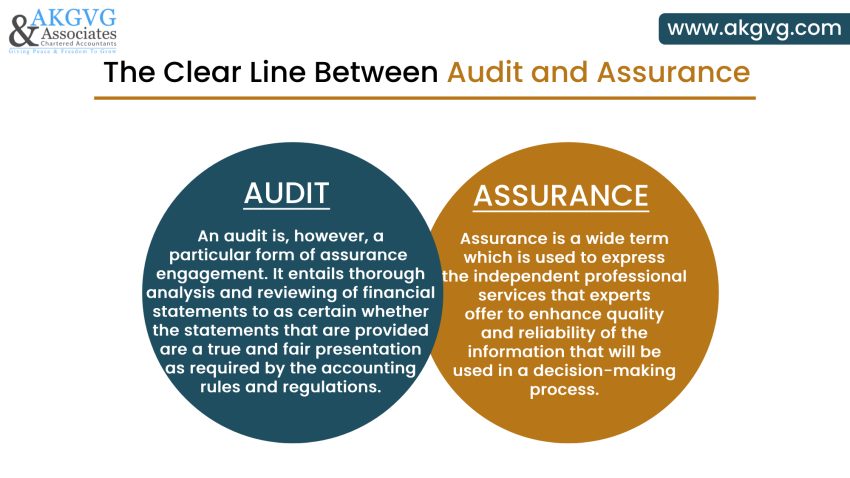

Assurance is a wide term which is used to express the independent professional services that experts offer to enhance quality and reliability of the information that will be used in a decision-making process. It does not apply to financial statements only, but it may span much broader scopes, including compliance, operations areas, risk assessments, sustainability reporting, and business processes. Assurance is the guarantee to stakeholders that the information which they have used is reliable, relevant and cannot be misstated drastically.

What is an Audit?

An audit is, however, a particular form of assurance engagement. It entails thorough analysis and reviewing of financial statements to ascertain whether the statements that are provided are a true and fair presentation as required by the accounting rules and regulations. Auditors include assessing the internal systems, examining the financial records, and giving their opinions on whether the financial records are without material misstatements or fraud. Put in simple terms, audit forms part of assurance services, a much narrower focus of financial reporting.

Key Differences Between Assurance and Audit

- Scope

Assurance covers a wide spectrum of information, ranging from financial statements to non-financial aspects like sustainability or compliance. An audit, however, is limited to examining financial records and statements. - Objective

The primary objective of assurance is to enhance the reliability and relevance of information used for decision-making. The objective of an audit is more specific: to verify the accuracy of financial statements and provide an independent auditor’s opinion. - Engagement Type

Assurance can take many forms such as reviews, agreed-upon procedures, and risk assessments. Audits are formal engagements that follow established auditing standards and involve issuing an audit report. - Level of Confidence

Assurance engagements can offer varying levels of confidence, from limited to reasonable. An audit, however, always aims to provide reasonable assurance that the financial statements are free from material misstatements. - End Users

Assurance reports are used by a wide variety of stakeholders including regulators, investors, management, and even customers. Audit reports are primarily intended for shareholders, investors, and regulators who rely on financial statements.

By examining these factors, it becomes clear that the difference between assurance and audit lies in their scope, purpose, and outcomes. Assurance has a wider scope, dealing with both financial and non-financial matters, whereas an audit is limited to examining financial statements.

Why Businesses Need Both

Both assurance and audit help business in the current competitive and controlled world. The security enhances confidence and credibility in the business activities and auditing increases the confidence on the financial reporting. Combined, they assist organizations in improving transparency and the regard of stakeholders.

Learning the distinction between the assurance and audit would provide companies with an opportunity to select the appropriate service. The difference is that an audit is a legal requirement on most occasions, but assurance services will give a second level of assurance beyond compliance. Finally, the two are significant in influencing the image of a company and its success in long term.

This content is meant for information only and should not be considered as an advice or legal opinion, or otherwise. AKGVG & Associates does not intend to advertise its services through this.