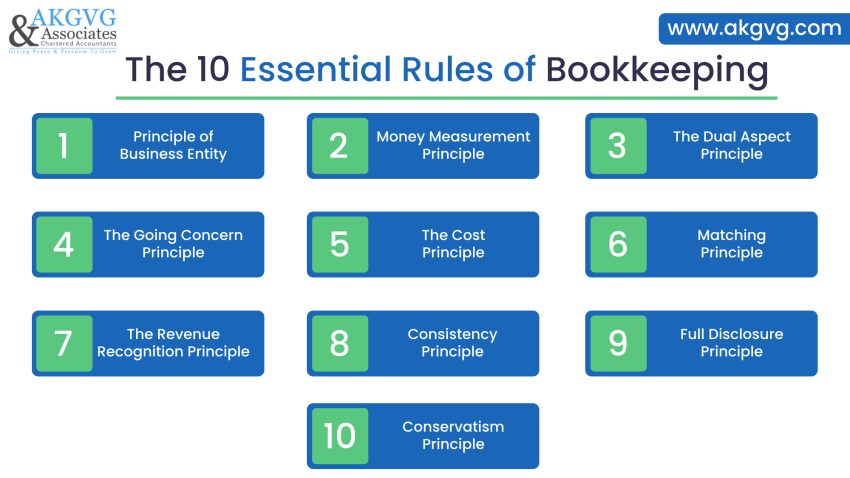

Bookkeeping is the engine that drives financial clarity in business. Whether you are running a start-up, a small enterprise, or a growing company, understanding the principles of bookkeeping is essential for accurate financial records and informed decision-making. These principles provide a standard framework that ensures consistency, accuracy, and transparency in managing accounts. Here are the 10 fundamental principles every business owner should know.

1. Principle of Business Entity

This principle means that business deals should be accounted in a different way as compared to the personal financial operations of the owner. It makes it clear and does not bring any confusion with personal expenses and business expenses.

2. Money Measurement Principle

The only transactions to be taken are those ones measurable in monetary terms. This implies that other aspects such as satisfaction of employees or reputation of the brand cannot be booked since they have no financial value unless otherwise.

3. The Dual Aspect Principle

The foundation of double-entry bookkeeping, this principle says every transaction has two sides – a debit and a credit – which must balance. This keeps the accounting equation (Assets = Liabilities + Equity) accurate.

4. The Going Concern Principle

Assumes that the business will continue operating for the foreseeable future. This affects how assets and liabilities are recorded, ensuring they reflect their ongoing use rather than liquidation value.

5. The Cost Principle

Assets are entered into the books at the amount you originally paid for them, rather than at what they might be worth in the market today. This approach keeps financial records unbiased and easy to verify.

6. Matching Principle

The revenues ought to be set against the costs incurred to earn them during the same time of the accounting period. This assists in giving proper representation on profitability.

7. The Revenue Recognition Principle

Revenue is recognized as it is received not when it is received. Through this principle, it is kept in mind that financial records are written in a way that represents the actual earning activity during a period.

8. Consistency Principle

When a business selects an accounting method, it is supposed to be applied consistently over time and periods. This simplifies the ability to compare time-based financial figures.

9. Full Disclosure Principle

All the financial matters concerning the company should clearly be reported. This entails any information which may cast an impact on the analysis of financial accounts.

10. Conservatism Principle

Under uncertainty, be conservative about the expenses and liabilities and account it at the earliest instance but record revenues when it is definite. This averts over stating profits and assets.

Why These Principles Matter for Business Owners

Putting these rules of bookkeeping to effective use, guarantees that any financial information is truthful, comparable, and reliable. It assists business owners in making improved decisions and meets the legal requirements and sustains investor faithfulness. Failure to adhere to these rules may put businesses at risk of financial misstatement, inappropriate management of cash flows and legal issues.

Conclusion

To sum it up, learning these principles of bookkeeping is not the duty of accountants alone; it is equally crucial for business owners who want to maintain a clear view of their company’s financial health. When these guidelines are applied in daily operations, they make records more reliable, reports more meaningful, and set the foundation for sustainable business growth.

These rules of bookkeeping can act as a guide in achieving money clarity, stability, and ultimate success when heeded earnestly. Although these concepts are old, they are still at the core of proper accounting even with the aid of modern software.

This content is meant for information only and should not be considered as an advice or legal opinion, or otherwise. AKGVG & Associates does not intend to advertise its services through this.