As we discussed in our previous blog about the validity of Rule 89, at last, we have discussed the Gujrat High Court Judgement Interpretation. Now, we are continuing our article with Madras High Court Judgement Interpretation.

Madras High Court Judgement Interpretation: –

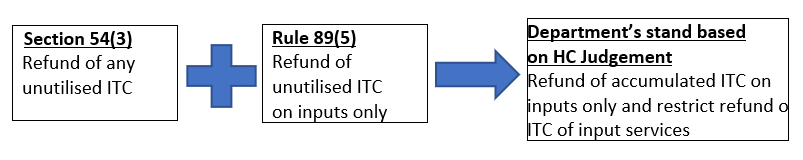

After witnessing divergent judgments by different High Courts, such a case attracted the attention of the Supreme Court of India. Both taxpayers and the Government approached the apex court and challenged the judgments passed by High Courts. With the Supreme Court’s judgment on the validity of Rule 89(5) of CGST Rules 2017, the saga of anomalies attached with the refund in case the Inverted duty structure has come to an end. The Apex court upheld the order of the Madras High Court & set aside the order passed by the Gujrat High Court. Judges passed the below mention judgment: –

“The above judicial precedents indicate that in the field of taxation, this Court has only intervened to read down or interpret a formula if the formula leads to absurd results or is unworkable. In the present case however, the formula is not ambiguous in nature or unworkable, nor is it opposed to the intent of the legislature in granting limited refund on accumulation of unutilised ITC. It is merely the case that the practical effect of the formula might result in certain inequities. The reading down of the formula as proposed by Mr Natarjan and Mr Sridharan by prescribing an order of utilisation would take this Court down the path of recrafting the formula and walk into the shoes of the executive or the legislature, which is impermissible. Accordingly, we shall refrain from replacing the wisdom of the legislature or its delegate with our own in such a case. However, given the anomalies pointed out by the assessees, we strongly urge the GST Council to reconsider the formula and take a policy decision regarding the same.”

From the judgment passed by the Supreme Court, it is quite evident that the court has refrained to intervene by way of redrafting the formula of refund as it respects the wisdom of legislature, rather it is a practical issue that needs to be taken care of by the GST Council. Further, to address this issue the Court has suggested the GST Council reconsider the formula and take care of the anomalies pointed out by the assesses, as due to the restrictions imposed by the constitution of India on the Judges to amend or frame any law the hands of the judiciary are tied to find a reasonable solution to such problem.

Now, if we apply the outcome of the Supreme court’s judgment in our case we discussed above, Mr. A can now not use the Gujrat High court’s judgment to claim a refund of accumulated ITC of both input and input services, rather now Mr. A must wait for further decision on the same by GST council to claim a refund of accumulated ITC of input services.

Further, in pursual of the supreme court’s suggestion, the GST council in its 45th Council meeting has addressed this issue. Council has recommended rate changes to correct inverted duty structure, in footwear and textiles sector, as was discussed in earlier GST Council Meeting and was deferred for an appropriate time which will be implemented with effect from 01.01.2022.

This content is meant for information only and should not be considered as an advice or opinion, or otherwise. AKGVG & Associates does not intend to advertise its services through this.

Posted by

CA Tarun Kapoor

AKGVG & Associates