Introduction

As per section 206C of the Income Tax Act 1961 (“the Act”), Tax Collected at Source (“TCS”) is a tax that sellers collect from buyers at the time of sale of specified goods. The applicable TCS compliances are:

- Collection & Payment: TCS needs to be collected by seller from the buyer at the time of receipt of consideration and the seller needs to be deposit the same with government by 7th of the next month.

- TCS Return Filing: The quarterly TCS return must be filed by the sellers vide Form 27EQ, by 15th of the next month from the end of the respective quarter, in which such goods are sold.

Amendment in section 206C (1F) w.e.f. 22nd April 2025

As per Notification no. 36/2025 dated 22nd April 2025, luxury purchases have now been brought under the ambit of TCS, resultantly people desirous of luxury items would end-up paying additional 1% TCS while making payment towards the purchases.

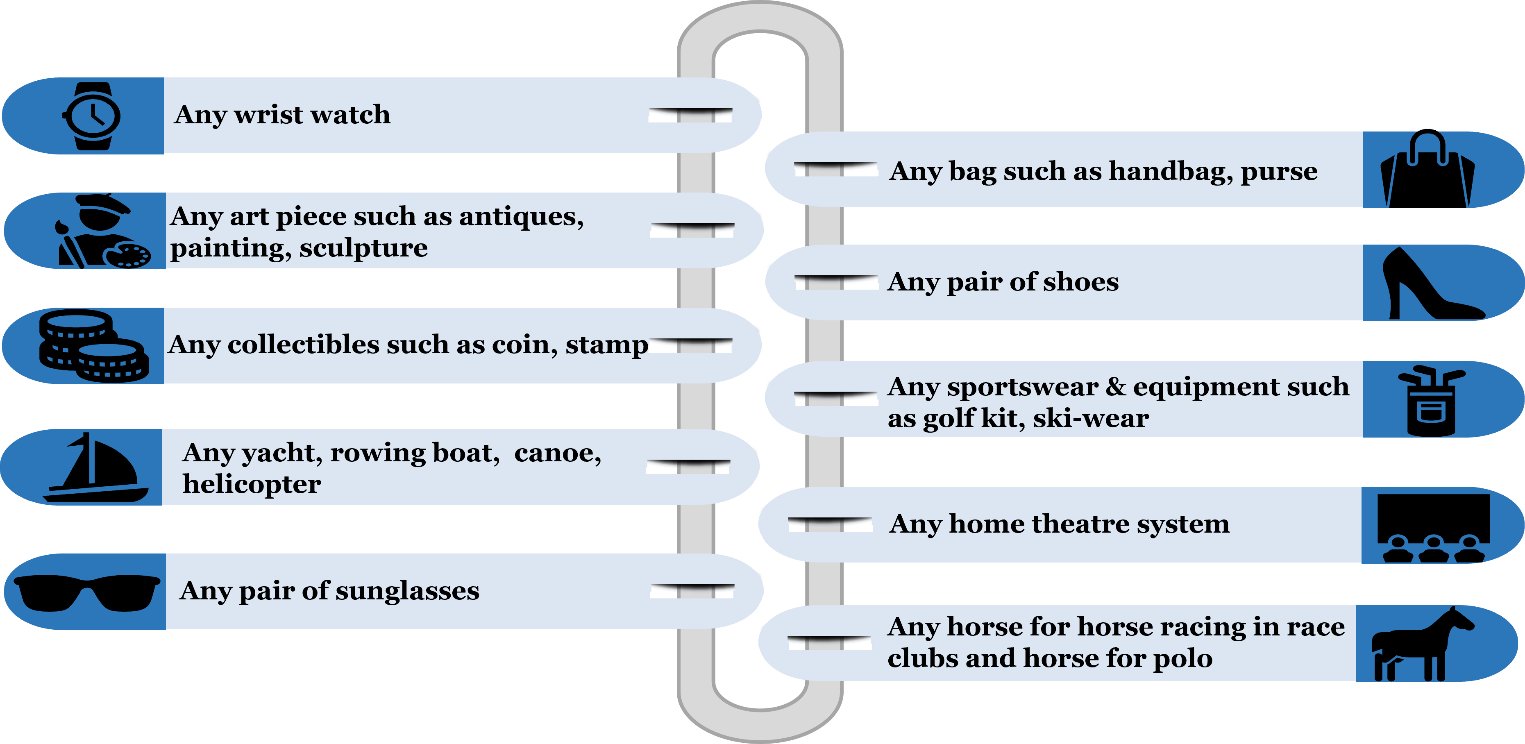

As per existing provisions laid u/s 206C(1F) of the Act, the TCS is required to be collected by the sellers from the buyers, on the sale of motor vehicles only. However, vide afore-mentioned notification, the CBDT has introduced the following items:

Any person, being a seller, who receives sale consideration exceeding ₹10 lakh, from the sale of motor car or above specified goods, is required to collect Tax Collected at Source (TCS) @ 1%, at the time of receipt of consideration for such purchase.

Further, as per Notification no. 35/2025 dated 22nd April 2025 a significant amendment has been made in Form 27EQ. Accordingly, other specified high-value goods such as luxury watches, art pieces, collectibles, yachts, and similar items have also been brought under the same category for TCS reporting purposes.

Given the above, one need to be cautious of the following:

- Effective 22nd April 2025, an additional 1% TCS will be payable at the time of purchase of specified luxury items.

- Taxpayers are advised to ensure that credit for the TCS paid, at the time of purchase, is duly claimed while filing their annual Income Tax Return.

This content is meant for information only and should not be considered as an advice or legal opinion, or otherwise. AKGVG & Associates does not intend to advertise its services through this.