Beware of Sham Entities Being Created Using Your Details

“Caution is the parent of safety”

With the development and access to technology across the globe, cybercrime is the biggest challenge in today’s world. Sharing personal information with others should always be in a secure manner which maintains the confidentiality of the data. In this digital era where every aspect of our life is taking place on online platforms, taking precautions is necessary to protect one’s identity and have the transactions settled securely.

To avoid getting caught in the trap, once the personal details are shared online, it becomes quite easy for any hacker or fraudster to use this information to make a profit either by tricking people or by selling these details to others.

So far, we have heard not to share any personal details with unscrupulous people in the banking field, with fake callers and replying to spam messages as it leads to fraud and embezzlement of funds. Now it’s time for people to be vigilant while complying with Goods and Services Tax provisions also.

As recommended by the Central Board of Indirect Taxes and Customs (CBIC), people must be more careful in protecting their personal information and credentials which they create on the GST portal i.e., www.gst.gov.in, as many rackets of tax evaders are coming forward.

Over the past years, Goods and Services Tax (GST) officials have caught several bogus firms, which were raising fake invoices and bills without any actual supply of goods/services. The sole intention is to claim an input tax credit (ITC) to set off the outward tax liabilities without any actual payment of tax.

In this tweet, CBIC is trying to make people aware that Aadhaar and PAN details can be used by hackers for creating fake entities in GST for evasion of taxes, and hence people should refrain from sharing these details without a valid reason.

So, let’s have an insight what all precautions one can take while entering the personal details and filing returns on the GST portal without getting trapped in the shell:

- PASSWORD: Avoid using common word combinations which can be easily guessed by anyone. Use passwords that meet the highest standards of security so that it becomes harder for any fraudster to crack it.

- AUTHENTICATION: While entering personal details like Aadhaar and Pan number one must check the SMS received on their mobile or e-mail that the same belongs from the government. With the help of this verification, the situation of facing any bogus activity is avoided.

- FIREWALL: It restricts the malicious data to flow into and out of a computer system when connected to a network. It protects against outside cyber attackers by shielding the system from unnecessary traffic.

- PHISHING: The email spam filters may keep phishing emails out of the inbox. But scammers are always trying to outsmart spam filters, so it’s a good idea to add an extra layer of protection by using security software. Keeping them up-to-date and using multi-factor authentication is the main to get rid of spammers.

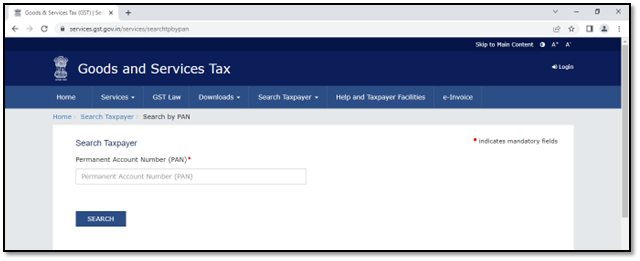

These easy steps can easily prevent hackers in some manner from utilizing online data and keep people safe from any possible threat. From the GST perspective, the government of India has provided a utility whereby a person can check whether an entity is registered on his/her PAN. The link for such utility is-

https://services.gst.gov.in/services/searchtpbypan

Additionally, CBIC should also come up with a utility wherein a person can check whether an entity is registered at a particular address or not. Also, strengthen the vigilance team in detecting tax evaders and discovering the bogus entities formed from the robbed data.

This content is meant for information only and should not be considered as an advice or legal opinion, or otherwise. AKGVG & Associates does not intend to advertise its services through this.

Posted by:

CA Tarun Kapoor

AKGVG & Associates