The new functionality of the interest calculator in GSTR-3B is now live on the GST Portal.

System computation of interest: After filing the GSTR-3B, the system will compute the interest liability on the basis of the values declared in the GSTR-3B. This computation will be done in accordance with the provisions of Section-50 of the Act, as amended.

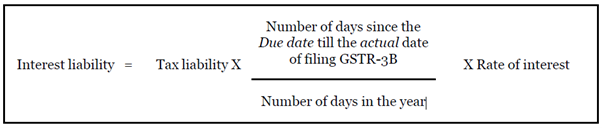

Interest will be computed for each tax period as per the following formula:

Depending on the number of tax periods declared by the taxpayer in the tax-period-wise break-up, the interest liability for each tax period will be calculated separately as per this formula. The interest values for different periods will then be added, and the total interest liability will be computed for each head by the system.

Even after the interest calculator is enabled on the GST Portal, there will be no change in the user experience for the taxpayers who have not made any delayed payment of tax liability pertaining to earlier period(s).