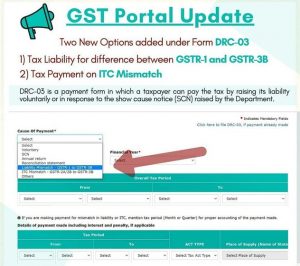

The Goods & Services Tax Network (GSTN) has provided 2 new payment options under Form DRC-3. One on account of Liability Mismatch – GSTR-1 to GSTR-3B and other on account of ITC mismatch – GSTR-2A/2B to GSTR-3B. The taxpayer can check the same by navigating the below mentioned path :

Dashboard>Services>User Services> My Applications> Intimation of Voluntary Payment.

These options have been enabled for taxpayers to make payment in relation to the differences arising on account of specific mismatch reasons as mentioned above.