CBIC has released informative snapshots to bust the myths being circulated in the trade & industry regarding CGST notifications issued dated 22nd December, 2020. Following myths have been cleared by CBIC :

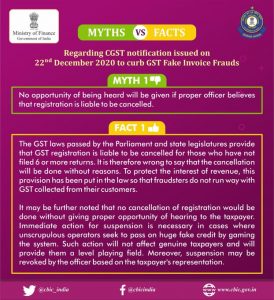

Myth 1 : No opportunity of being heard will be given if proper officer believes that registration is liable to be cancelled.

Fact 1 : The GST laws passed by the Parliament and state legislatures provide that GST registration is liable to be cancelled for those who have not filed 6 or more returns. It is therefore wrong to say that the cancellation will be done without reasons. To protect the interest of revenue, this provision has been put in the law so that fraudsters do not run away with GST collected from their customers.

It may be further noted that no cancellation of registration would be done without giving proper opportunity of hearing to the taxpayer. Immediate action for suspension is necessary in cases where unscrupulous operators seek to pass on huge fake credit by gaming the system. Such action will not affect genuine taxpayers and will provide them a level playing field. Moreover, suspension may be revoked by the officer based on the taxpayer’s representation.

Myth 2 : Even if there is a clerical error in filing returns, GSTIN will be cancelled. No option to correct your mistakes.

Fact 2 : This absolutely not true. Only in fraudulent cases where there are significant discrepancies based on data analytics and sound risk parameters, and not mere clerical errors, the action of suspension & cancellation will be taken up. An example of a fraudulent case and serious discrepancy is where one has passed on crores of rupees of ITC and not filed GSTR-3B returns, nor has he filed ITR or disclosed very little liability in ITR’s etc. The GST ecosystem is very carefully working towards curbing the fake invoice frauds in the interests of bonafide taxpayers. GST system applies sophisticated tools like BIFA, data analytics an AI & ML to pinpoint and segregate these fraudsters only.

Myth 3 : The proposed changes will impact ease of doing business.

Fact 3 : Not true. Fraudsters are misusing the system to the detriment of the interest of genuine taxpayers. Consequently, data driven targeting of the fraudsters is the need of the hour. The data is being collected from Income Tax, Banks, Customs and necessary matching is being done to identify fraudsters to take action of suspension & cancellation after following due process of law. Precise targeting of fraudsters is being done only in specific cases, after doing a comprehensive analysis, using advanced data analytics tools, etc. Further, multiple risk indicators are checked and only then few high risk entities are selected. Action against fraudsters will not impact the Ease of Doing Business which is achieved in GST through liberal registration, refund regime and self-compliance system with little or no manual checks.

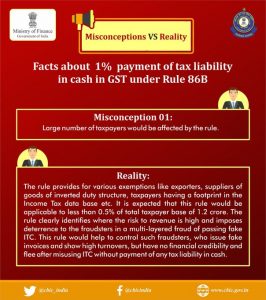

Myth 4 : Large number of taxpayers would be affected by Rule 86B.

Fact 4 : Rule 86B provides for various exemptions like exporters, suppliers of goods of inverted duty structure, taxpayers having a footprint in the Income Tax database etc. It is expected that this rule would be applicable to less than 0.5% of the total taxpayer base of 1.2 crores. The rule clearly identifies where the risk to revenue is high & imposes deterrence to the fraudsters in a multiple-layered fraud of passing fake ITC. This rule would help to control such fraudsters, who issue fake invoices & show high turnovers, but they have no financial credibility and flee after misusing ITC without payment of any tax liability in cash.