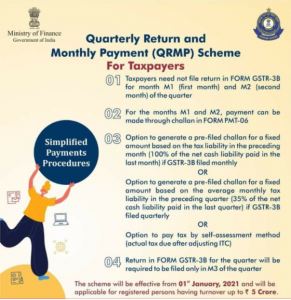

The QRMP (Quarterly Return & Monthly Payment) scheme will be effective from 1st January, 2021 and will be applicable for registered persons having turnover up to ₹ 5 crores. CBIC has clarified that the taxpayers availing the QRMP scheme are not required to file GSTR-3B in the 1st (M1) & 2nd (M2) month of the quarter. It will be required to be filed only in 3rd (M3) month of the quarter for the entire quarter.

Further for the months M1 & M2 payment can be done through challan PMT-06 in any of the manner mentioned below :

- If GSTR-3B was filed on Monthly Basis : Option to generate a pre-filled challan for a fixed amount of 100% of the Net Cash Liability paid in the last month of the previous quarter OR

- If GSTR-3B was filed on Quarterly Basis: Option to generate a pre-filled challan for a fixed amount of 35% of the Net Cash Liability paid in the previous quarter OR

- Pay actual tax due after adjusting ITC as per self-assessment method.